The Deposit Protection Fund of Uganda (DPF) is a government agency that provides deposit insurance to customers of deposit-taking institutions licensed by Bank of Uganda.

The Deposit protection Fund of Uganda (DPF), which is also referred to as the Fund, was established as a separate legal entity following the enactment of the Financial Institutions Act Cap. 57. Prior to this, DPF was managed by Bank of Uganda.

The process of operationalizing the Fund commenced….

Welcome to our website, which is our main online gateway for sharing information with the public. Complementary to our social media platforms, the website supports the traditional modes of communication with the public.

Welcome to our website, which is our main online gateway for sharing information with the public. Complementary to our social media platforms, the website supports the traditional modes of communication with the public.

Once again, we are the Deposit Protection Fund of Uganda (DPF), a government agency that provides protection to…

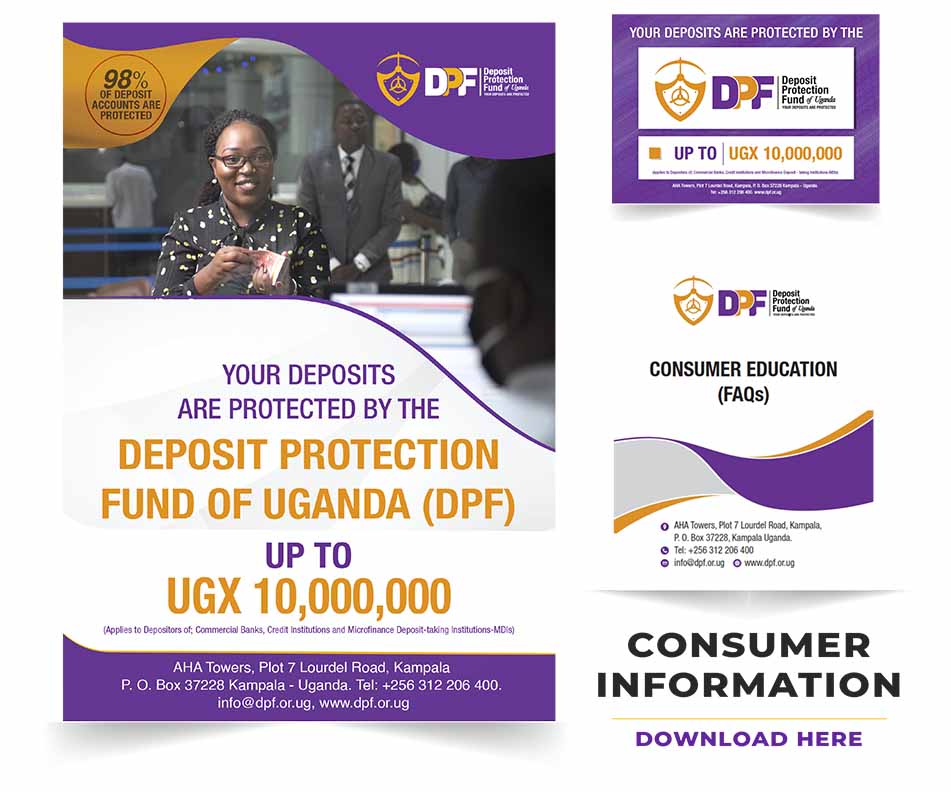

The Deposit Protection Fund of Uganda (DPF) has been executing its mandate of paying depositors of EFC Uganda Limited and Mercantile Credit Bank Limited up to the protected limit of UGX 10million, following their closure by Bank of Uganda. However, there are still a number of depositors who held Individual, Company, Joint, Registered Trusts, Minors’, SACCOs or Investment club accounts who have not yet made claims for payment of their protected deposits. The DPF therefore informs the general public as follows;

…

On behalf of the Board of Directors of the Deposit Protection Fund of Uganda (DPF), I am pleased to release the Fund’s Integrated Annual Report June 30, 2024. I am delighted to report that during the financial year 2023/24, the Fund witnessed remarkable growth in its key financial parameters and accomplished 90 percent of the major activities which were highlighted in its Corporate Balanced Scorecard.

The report was submitted to the Minister of Finance, Planning and Economic Development within the stipulated statutory period in accordance with the provisions of Section 111D of the Financial Institutions Act, 2004 as amended. The Auditor General issued an unqualified opinion on the Fund’s financial statements, indicating that the financial statements were presented fairly in all material respects.

During the period under review, total assets of the Fund increased by 15 percent, from UGX 1,405 billion to UGX 1,620 billion as at June 30, 2023 and June 30, 2024 respectively. The increase was largely attributed to investments in treasury instruments, which increased from UGX 1,374 billion to UGX 1,595 billion over the same period. On the other hand, total liabilities were largely stable with a 6 percent increase to UGX 59 billion. Total reserves posted a positive change of 16 percent to UGX 1,560 billion from UGX 1,350 billion recorded in the previous financial year. The comprehensive income of UGX 211 billion earned over the year, was the primary driver for the growth in total reserves. The Fund therefore ended the year with a strong financial position.

During the year, DPF demonstrated its resolve and ability to contribute to financial sector stability, by starting to pay depositors of the two financial institutions which were closed, within an average record period of less than 6 days after closure. The swift and decisive action taken by the Fund, working very closely with Bank of Uganda, no doubt fostered the much-needed confidence in the banking sector at that time.

As we embark on the new financial year, emphasis will be placed on enhancing the depositor payout system, to serve depositors more conveniently. On behalf of Management and the staff of the Fund, I take exception to extend appreciation to all our stakeholders who have continued to walk the journey with the Fund.

Dr. Julia Clare Olima Oyet (Mrs.)

Chief Executive Officer