DPF Champions Financial Inclusion at the East African Capital Markets Conference 2025 – October 17, 2025

The Deposit Protection Fund of Uganda (DPF) participated as a sponsor at the East African Capital Markets Conference 2025, held at the Sheraton Kampala Hotel on October 16 – 17, 2025. The high-level regional event was organized by the Capital Markets Authority (CMA) and the Uganda Securities Exchange under the theme: “Shaping East Africa’s Capital Markets through Digital Transformation and Sustainable Finance”, and attracted policy influencers, regulators, and financial sector stakeholders from across East Africa. As a member of the Financial Sector Stability Forum (FSSF), DPF collaborates with other sector players to promote resilient and inclusive financial ecosystems across East Africa.

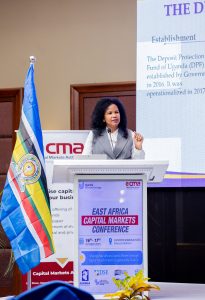

Representing the Fund, Dr. Julia Clare Olima Oyet (Mrs.), the Chief Executive Officer, delivered a presentation on “The Role of Deposit Protection in Deepening Financial Inclusion and Access to Formal Finance.”

Dr. Julia Oyet emphasized the critical role of deposit protection in fostering financial inclusion and building public confidence in the financial system. She highlighted that when people are assured that their savings are protected, they are more likely to trust formal financial institutions, thereby promoting greater participation in the formal economy especially among the underserved population.

Bringing it closer to home, Dr. Julia observed that the Fund’s public awareness and efficient payout efforts contribute to confidence in the banking sector, thereby contributing to an increase in the financial inclusion levels in Uganda. DPF paid depositors in the now defunct EFC Bank Ltd & Mercantile Credit Bank Ltd, on average – 6 days after closure of the two institutions by the Bank of Uganda in 2024. The law provides for 90 days.

She drew participants’ attention to the following;

- DPF does not handle depositor complaints for operational banks, Bank of Uganda does.

- When reimbursing depositors of closed banks, loans are offset.

- Depositors are encouraged to update their information with their respective bankers when called upon.

- The public should ignore rumours and always seek information from credible sources.

- Former depositors of EFC and Mercantile Credit bank should submit their claims to DPF

DPF’s participation in the Conference aligns with its strategic objective of enhancing awareness and appreciation of its mandate. By engaging in such forums, DPF reinforces its commitment to financial stability and inclusion, key pillars for Uganda’s and the region’s sustainable economic growth.

The DPF provides deposit insurance of up to UGX 10 million to customers of deposit-taking institutions (Commercial banks, Credit Institutions and Microfinance deposit taking Institutions) licensed by Bank of Uganda. Deposits above the protected limit are paid by the liquidator depending on recoveries made.

Dr. Julia Oyet is passionate about the subject of financial inclusion. For her Doctoral thesis, she examined commercial banking and financial inclusion of Uganda’s middle class. Read more about her work here.