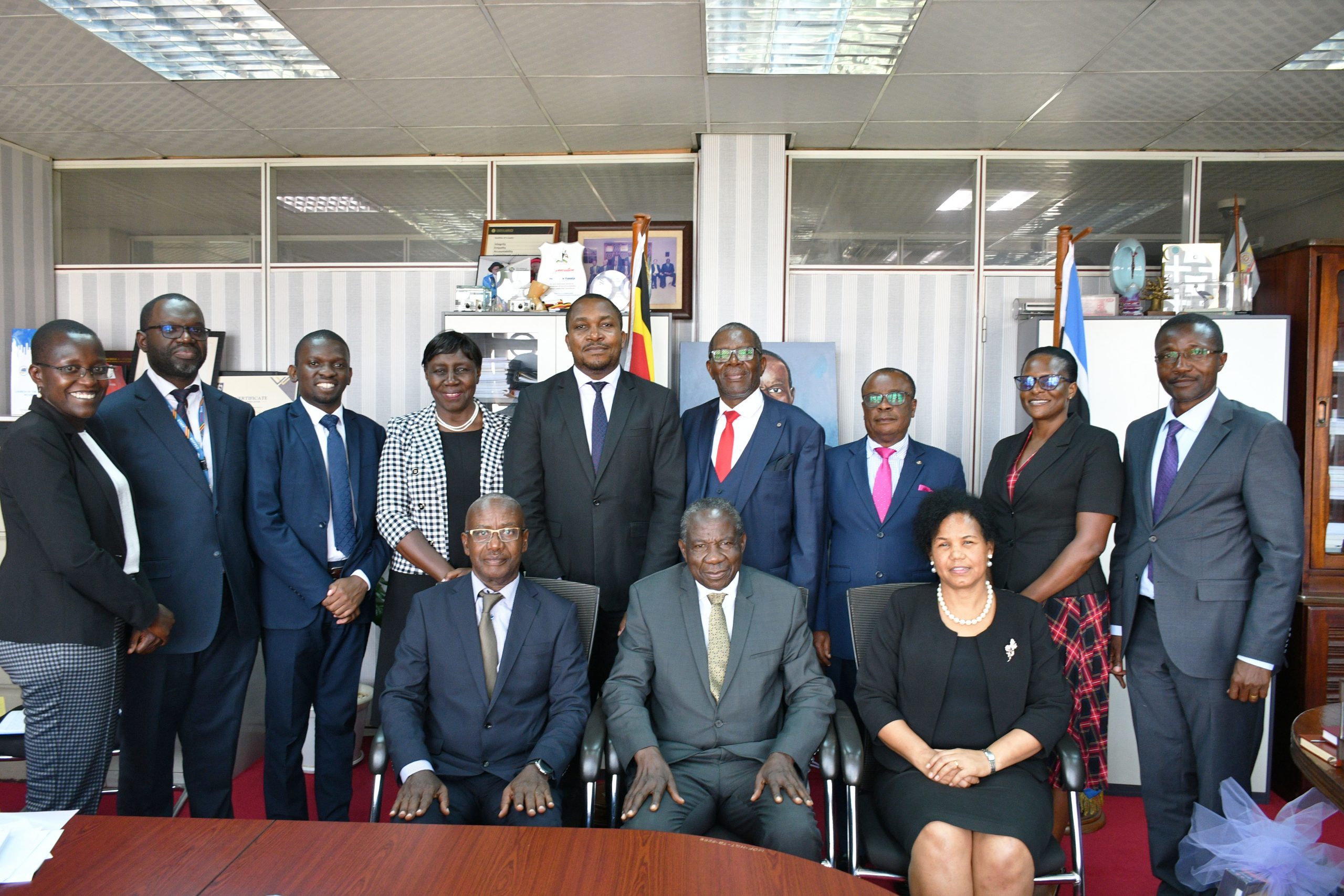

Courtesy Visit to Centenary Bank by the Deposit Protection Fund of Uganda – December 21, 2022

A team from the Deposit Protection Fund of Uganda (DPF), led by the Chief Executive Officer Mrs. Julia Clare Olima Oyet, paid a courtesy to the Managing Director of Centenary Bank. Mrs. Oyet was accompanied by Director Legal and Board Secretary Mrs. Angela Kiryabwire Kanyima, Director Communications Mr. Patrick O. Ezaga, Acting Director Finance and Operations Mr. Moses Tamale, Assistant Manager Business Process Automation Mr. Nicholas Odwoka and the Senior Officer Legal Mr. Jude Lubega.

Mr. Kasi’s delegation included, the Chief Manager Finance and Reporting Ms. Patricia Muganga, Chief Manager Corporate Affairs and Communications Ms. Allen Ayebare, General Manager Compliance Mr. Frank Kabagambe and the Chief Manager Legal Innocent Kyakuha.

Mrs. Oyet appreciated Centenary Bank management team for hosting the Fund and informed them that the purpose of the visit was to create awareness of the Fund’s operations and to strengthen its relations with stakeholders. She briefed the Bank about the history of the Fund, its mandate and operations. She further informed the Bank about the major projects being undertaken by the Fund, which included; the development of the Depositor Payout & Premium Management System (DPPMS), drafting of the stand-alone DPF law and public awareness.

Mr. Kasi welcomed the DPF team and gave them an overview of the bank and noted that the bank would be making 40 years of existence in 2023 with the largest branch network and customers. He also updated the team that the bank was now under Centenary Group, which was formed recently and has other subsidiaries like the Cente Foundation and Cente Tech.

Mrs. Kiryabwire, DPF Director Legal and Board Secretary informed the bank that the Fund was in the process of coming up with a stand-alone law (DPF Regulatory Framework) and as such, undertook a regulatory impact assessment in which members of the banking sector were involved and consulted. She also highlighted that the Fund would work closely with the Central Bank of Uganda in drafting the regulatory framework since both entities are governed by the Financial Institutions Amendment (2016) Act and work together.

In giving the bank an update about the Depositor Payout and Premium Management System, Mr. Odwoka informed them that the system will be used to pay depositors in the unlikely event that a Contributing Institution is closed. He also informed the team that the system will automatically compute premiums and bill Contributing Institutions accordingly. Mr. Odwoka further added that banks will be able to upload depositor information on a portal which is highly secured.

While applauding the bank for its compliance levels of the Single Customer View project, DPF Acting Director Finance and Operations; Mr. Moses Tamale, informed the bank that there was still need to ensure that more customers update their records with the National Identification Number (NIN), alternative bank account or mobile number. He emphasized the need for this stating that it is those details which will be captured in the Depositor Payout and Premium Management System.

Mr. Patrick O. Ezaga, DPF Director Communications appreciated the bank for its compliance efforts in ensuring that the PDF promotional items such as the posters, stickers and brochures are well displayed within the banking halls as required by law. He also informed the bank that the Fund is undertaking a dipstick survey with Contributing Institutions to establish their level of satisfaction with the Fund’s operations so that it can forge ways on how to serve them even better. Mr. Ezaga concluded his remarks by informing the bank that the Fund intends to engage its frontline staff as part of its public awareness activities and requested for its cooperation when the time comes. He stated that this will be in form of training sessions either physical or online and that the emphasis on front line staff is because they interface with customers and should be able to answer any questions about DPF when asked.

In his concluding remarks, Mr. Kasi appreciated the DPF team for the visit, and all the projects being undertaken to ensure financial sector stability is maintained in the unlikely event of a bank closure. He informed the team that the staff trainings are welcomed and can be scheduled upon request. Mr. Kasi pledged to continue working well with the Fund in ensuring the stability of the financial sector.