DPF hosted at Cairo Bank for an inspection entry meeting and a courtesy visit – March 27, 2023

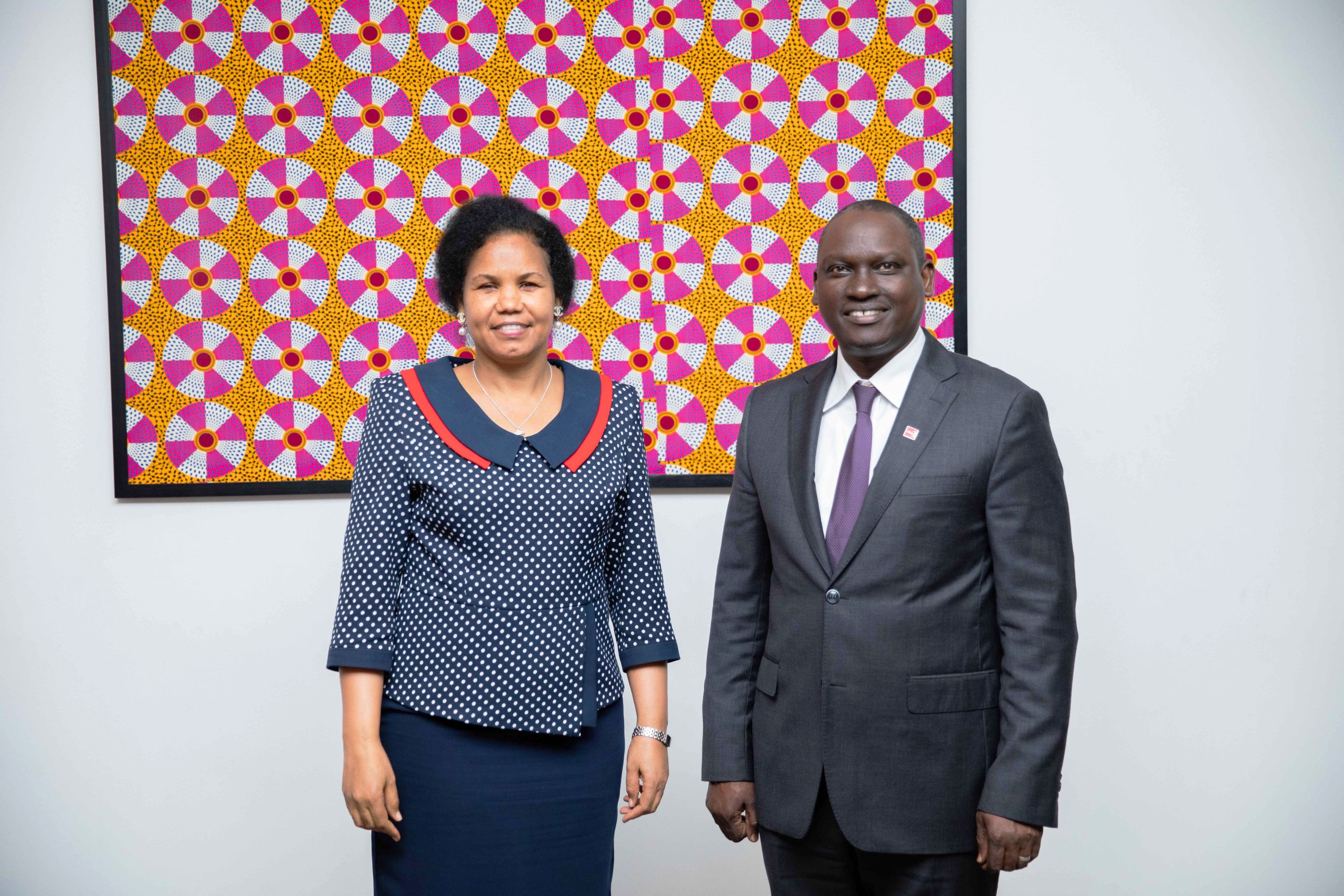

A team from the Deposit Protection Fund of Uganda (DPF) paid a courtesy visit to Cairo Bank Limited on March 27, 2023. The visit also doubled as an entry meeting for the on-site inspection exercise by DPF, which is due to start on March 28th. The DPF team led by the Ag. Chief Executive Officer Mr. Patrick O. Ezaga met with the Cairo Bank Management team led by its Managing Director, Mr. Ahmad Maher Nada.

In his remarks, Mr. Ezaga appreciated Cairo Bank team for the warm reception despite their busy schedules. He shared brief remarks about the concept of deposit insurance at the global and national perspectives and the mandate of DPF. He reiterated to the meeting about the deposit insured limit of UGX 10,000,000 and noted that at this current limit, 98% of depositors were covered.

On public awareness, Mr. Ezaga highlighted the importance of spreading the deposit insurance message to the public, especially to those at the bottom of pyramid noting that this category were the primary target of deposit insurance. He emphasized the significance of ensuring the correctness of the messages disseminated by the different financial institutions to ensure consistency in communication to the public. Mr. Ezaga informed the meeting that Bank of Uganda’s role was to ensure an orderly process in the event that a financial institution were to exit the sector so as to curtail any resulting shocks on the economy. He concluded that the Fund works closely with the Central Bank to support this effort.

Mr. Yusuf Mukiibi, the Director Finance & Operations appreciated the Cairo Bank team for paying its premiums. He informed the bank’s team about some of the projects the Fund was undertaking top among which include the Depositor Payout & Premium Management System project and the Single Customer View (SCV) in which banks are expected to upload depositor information to facilitate an efficient payout process by the Fund if the need arose. Mr. Mukiibi underscored the need for financial institutions to ensure that customer records are kept up-to-date. These include the National Identification Number (NIN), alternative bank accounts and the mobile money numbers registered in a depositor’s name.

On his part, Mr. Nada welcomed the DPF team, noting that Cairo Bank was appreciative of the visit and noted that his team had beneficiated tremendously from the engagement and as such, was committed to supporting the Fund in its upcoming inspection activity as well as other efforts.