DPF participates in the sensitization workshop for large SACCOs organized by Bank of Uganda

Bank of Uganda invited the Deposit Protection Fund of Uganda to a sensitization workshop for Large SACCOs on February 7, 2024, at Hotel Triangle, Mbarara City. The event aimed to sensitize the Board and Management of Large SACCOs on the requirements under Section 110 of the Tier 4 Microfinance Institutions and Money Lenders Act, 2016, highlighting the Central Bank’s supervisory duties according to the 2023 regulations. This initiative addresses the amended legislation that mandates SACCOs with savings over UGX 1.5 billion and capital above UGX 500 million to secure operating licenses from the Central Bank.

Mr. Balaam Ssempala, representing the Fund at this event, delivered a presentation on the genesis and mandate of the Fund. He stated that membership in the Fund is mandatory for all BOU-supervised deposit-taking institutions. He highlighted that deposits are protected up to UGX 10 million per depositor, covering 98% of all deposit accounts. He further explained that payments are issued per depositor, not per account, with deductions for any outstanding loans, using the National ID Number (NIN) from the single customer view records. Additionally, he said that company and joint account signatories must provide their NIN to enable payments through an alternate bank account.

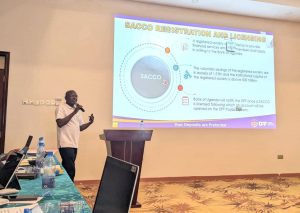

Mr. Ssempala also discussed how new regulations have led the Fund to work closely with the Central Bank to include Large SACCOs under its protection. Once these SACCOs are licensed by the Central Bank, they become eligible for registration with the Fund, enabling access to the Payout System using Single Customer View Data.

In his closing, Mr. Ssempala emphasized the importance of depositors keeping their account information, such as NIN and mobile numbers, current to streamline payouts in the unfortunate event of a Contributing Institution’s closure by the Central Bank.